Arbor Investment Planner Value Investing Guide (Content & Links)

Investment Analysis

Intrinsic Value Stock Analysis – My Formula <=NEW Must Read

Dividend Stocks Analysis Checklist

Cash Flow From Operations (CFO) Calculations & Ratios

Piotroski F-Score Stock Screen

PEG Ratio: Useful or Obsolete Valuation Metric

Earnings Yield & How to Calculate Earnings Yield

Market Capitalization: Calculations and Categories

Explain Free Cash Flow and Free Cash Flow Yield

Gross Profitability Ratio – Qualitative Analysis

Dividend Coverage Ratios: How Safe is Your Dividend?

Dividend Yield: Definition, Calculation, & Relationship

Dividend Payout Ratio vs. Cash Dividend Payout Ratio

Net Financial Debt and Ratios: Analyzing Leverage & Risk

Enterprise Value (EV) and Calculating EV Ratios

Net Cash Flow and Cash Flow Earnings

Types of Cash Flow and Cash Flow Calculations Guide

Cash Flow Statement Analysis: Purpose, Components, and Format

Purpose of Financial Statements

Return on Total Assets – Calculations & Ratios

Return on Capital – Calculations & Ratios

Geometric Average vs. Arithmetic Average: Which is Correct for Investment Returns?

Owner Earnings vs. Cash Profits

High Probability Strategies For Investment Analysis

Risk

5 Portfolio Risk Management Strategies <= Must Read

Stock Market Risk: Analyzing and Finding Solutions

Standard Deviation, Probability, and Risk When Making Investment Decisions

Alpha and Beta: How Do They Relate to Investment Risk?

Systematic Risk, Unsystematic Risk, Probability, and Expected Value

Investment Risk Management Plan

Portfolio Management / Asset Allocation

34 Investment Strategies and Rules to Make You a Better Investor <= Must Read

Maximum Drawdown and the Concept of Probable Maximum Loss

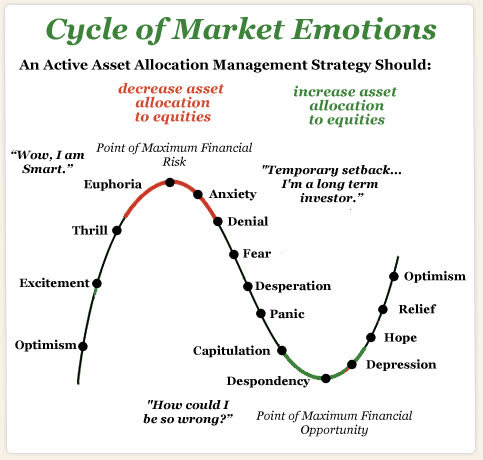

Tactical Asset Allocation Versus Strategic Asset Allocation

Asset Allocation Categories & Guidance

Inflation Guide: Asset Allocation Based on the Inflation Trend

What is an ETF? Advantages & Disadvantages

Asset Allocation By Age: A Rule of Thumb to Forget?

Over Diversification: Hurting Your Investment Returns?

Buy and Hold Works….Until It Doesn’t

Treasury Inflation Protected Securities (TIPS) – Benefits and When to Buy

The Most Important Thing Book Review

92 Quotes From The Most Important Thing

Investment Portfolio Management Basics

Disadvantages of Diversification

Investment Concepts Fundamental to Value Portfolio Management

Portfolio Rebalancing and Weighting Strategies

Stock Market Crash? Is Your Asset Allocation Right?

Is Investment Asset Allocation By Age Valid?

Are Your Investment Returns Suffering From Over Diversification

Investment Basics

Investing Principles Fundamental to Successful Outcomes <= Must Read

Dividend Investing – 6 Important Advantages

5 Most Important Factors to Increase Your Portfolio Value

Exponential Growth, Double Time, and the Rule of 72

3 Steps to Avoid Repeating Investment Mistakes

Fundamental and Technical Analysis: What is the Difference?

Explain Bonds, Bond Terms, Price and Yield, Types of Bond Risk

What is Common Stock? Advantages and Risk

Investment Diversification Definition and Purpose

Reinvesting Dividends Benefits

What is the Difference Between Saving, Investing, and Gambling?

3 Types of Investors – Which Type Are You?

Dividend Growth Compounding Versus Interest Compounding

Investment Probability: Is it Dangerous to Market Predictions?

Slow and Steady Wins The Race in Investment Management

Selling a Stock – Good Reasons and Common Mistakes

Purpose of Financial Statements Analysis

Stop Loss Orders: An Investment Tool Investors Should Avoid?

Value Investing

Who is Benjamin Graham? How Did He Change Security Analysis?

Mastering The Market Cycle by Howard Marks: Review & Quotes

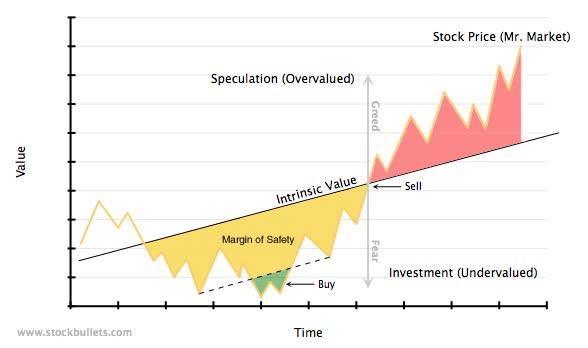

How to Use Valuation Analysis to Time the Market

The Intelligent Investor Book Review

74 Quotes From The Intelligent Investor

Shiller PE 10: Advantages, Criticisms, and Implementation

Warren Buffett Strategy: Long Term Value Investing

Sustainable Competitive Advantages

Investment Decisions Should be Valuation Based

Value Investing Quotes – Wisest Men Compilation

Quantitative and Qualitative Approach to Value Investing

Value Trap or Real Value Investment?

Book of Value Quotes by Anurag Sharma

Be Fearful When Others Are Greedy

Dividend Value Builder Newsletter

All Three DVB Newsletters for $99/year.

Minimize Large Portfolio Drawdowns

Invest With Confidence in Less Time - Manage Your Portfolio Without Behavioral Errors