Arbor Investment Planner – Premium Services

Selecting dividend stocks can be difficult and time consuming. A Dividend Value Builder Membership provides a time saving approach to discover, compare, and evaluate dividend stocks without emotional bias.

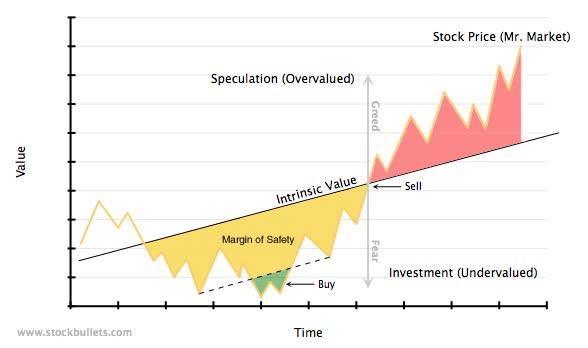

We analyze companies with fundamental quantitative analysis to estimate an intrinsic value and compare it the the current price. This provides us with a margin of safety and estimate of forward returns as the stock price gravitates toward intrinsic value over time.

Each of our stocks is evaluated and receives a risk / stability grade (macro & micro) and a quality grade specific to the company. This allows us decipher some of the strengths and weakness of each company.

Our intrinsic value / margin of safety analysis eliminates the companies with unfavorable stock prices. This allows our members to concentrate on stocks that offer a margin of safety and a favorable long term risk/reward ratio.

Dividend Value Builder Membership

- Discover, Evaluate, and Compare Dividend Stocks Without Emotional Bias

- No Risk 30-Day 100% Money Back Guarantee (First-Time Reviews Only)

- Each Issue of the Dividend Value Builder Newsletter (24 Issues/yr.) includes intrinsic value analysis of 300+ stocks with: Target BUY Price, Target Sell Price, Current Price, Annual Dividend, Dividend Yield, Consecutive Years of Dividend Increases, Estimated Intrinsic Value, Estimated Margin of Safety, Projected 5 Year Total Return (Annualized), Risk/Stability Grade (Macro & Micro), Quality Grade (Specific to Company), and Ken's Notes.

- All AAAMP Portfolios stocks are analyzed in each issue with a one page summary

- Key Market Statistics

- Links & Learning Page

- Perfect for the novice investor or experienced investor looking for a great place to begin research.

- DVB Newsletter usually published on or before the first and third Sunday of each month.

- PLUS: AAAMP Portfolios / DVB Buy Signals E-mails (approx. 48 /year - usually weekly)

- AAAMP Portfolios Membership -

AAAMP Portfolios memberships are by invitation only. I want to make sure my service is right for you before you invest in my service. Contact Ken Faulkenberry @ 832-585-7618 or KFinvest@aaamp.net for more information and invitation to join.

AAAMP portfolios are designed to assist investors in managing their own money in a minimum amount of time. The portfolios are laid out in a simple and concise manner with easy to follow specific trade alerts. This service provides all the resources so you can develop your own plan with confidence. I do the work, you stay in control!

The highest priority of each portfolio is minimizing large portfolio drawdowns. Asset allocation decides up to 90% of total investor returns. This is where investors make the most mistakes and the largest behavioral errors. I will help you concentrate on the aspects of investing that grow wealth little by little.

We focus on ideas and concepts inspired by Benjamin Graham (The Intelligent Investor) and Howard Marks (The Most Important Thing). This philosophy puts special emphasis on value investing strategies: requiring a margin of safety, risk management, proper asset allocation, and avoiding behavioral errors.

Our approach is to invest defensively when valuations are high. However, we want to be ready (emotionally) and able (cash!) to invest more aggressively when a margin of safety exists. This reduces portfolio volatility and allows us to avoid large drawdowns that destroy long term returns.

I am dedicated to helping investors implement sound investment strategies, methodically build wealth, and mitigate risk. Each model portfolio is a real-time portfolio; part of my personal retirement portfolio. In other words I put my money where my mouth is!

AAAMP Premium Membership

- Includes Dividend Value Builder Newsletter plus all 7 AAAMP Portfolios (every service I produce, current & future).

- ALL AAAMP Portfolios are real-time asset allocation portfolios (equities & income) and include specific & concise trade alerts e-mailed before every transaction.

- AAAMP Treasure Trove Dividend (TTD) - uses a value approach concentrating on companies with sustained dividend growth over many years, catering to both growth and income-oriented investors. #1 priority is avoiding large drawdowns.

- AAAMP Global Dividend Value (GDV) - is a moderate/flexible asset allocation portfolio, our highest-quality global growth & income portfolio, designed for retirement and growth-oriented investors.

- AAAMP Dividend Growth & Income (DGI) - is an aggressive/flexible asset allocation portfolio employing sector and quality diversification to maximize total return. It is tailored for investors seeking a balanced mix of dividend income and growth.

- AAAMP Global Value (GV) - is designed for investors seeking high total returns through global investment opportunities. With its conservative yet flexible asset allocation, this portfolio caters to both retirees and growth-oriented investors.

- AAAMP Global Value Aggressive (GVA) is one of our more aggressive portfolios and a long term growth portfolio option. Our goal is to build wealth with an approach that invests aggressively but with a healthy dose of risk management.This is the more aggressive brother of our more conservative Global Value portfolio. The GVA will hold many of the same investments but with a sprinkling of higher return/higher risk investments and a more aggressive overall asset allocation.

- AAAMP Global Conservative Income (GCI) - is our most conservative global asset allocation portfolio, featuring high quality assets. It is tailored for retirees and to be a secondary option for investors seeking income with reduced risk and enhanced stability compared to other AAAMP Portfolios.

- AAAMP Global High Income (GHI) - flexible asset allocation portfolio holding individaul asset with above average yields and risks, making it an excellent complimentary choice for investors seeking higher returens and greater diversification in a secondary portfolio.

- Call Ken Faulkenberry at 832-585-7618 for membership access and a free preview of all services.

Have Questions?

Call me directly at 832-585-7618.

Ken Faulkenberry