Dividend Value Builder Newsletter

– Discover, Compare, and Evaluate Dividend Stocks Without Emotional Bias –

(Intrinsic Value Analysis For Over 300 Stocks)

5 Portfolio Risk Management Strategies

You can’t control the direction or volatility of stock prices. We’re going to focus on 5 portfolio risk management strategies that you can control.

Everyone wants high investment returns. Volumes of books, articles, and blog posts can be found on how to “beat the market”. But is that the right goal to have? Or should you think differently and focus more on portfolio risk management instead of returns?

The best investors focus on risk not returns. The good returns will come if you manage your risk properly. We only want to take prudent risks; those risks which offer probabilities which are in our favor.

Our priority is portfolio risk management strategies that avoid large drawdowns of your investment capital.

Avoiding large drawdowns is the same as Warren Buffett’s famous rules:

Rule No. 1: Never Lose Money

Rule No. 2: Never Forget Rule #1

Sometimes rules seem so simple some investors have a tendency to overlook them. However there is a profound reason why Buffett and other successful investors make this priority #1.

Drawdowns cause exponentially greater damage the larger the drawdown. In other words:

It takes an 11% gain to recover a 10% loss. Not a problem.

It takes a 25% gain to recover a 20% loss. Harder.

It takes a 43% gain to recover a 30% loss. Problem.

It takes a 67% gain to recover a 40% loss. Big problem.

It takes a 100% gain to recover a 50% loss. Devastating.

It takes a 300% gain to recover a 75% loss. Catastrophic.

The best approach to make money in the long term is not losing it in the short term.

Five Portfolio Risk Management Strategies:

1. Establish a Probable Maximum Loss Plan

A probable maximum loss plan is the first step in avoiding losing a large chunk of your portfolio. Bear markets can destroy portfolios for years to come. Many investors just give up and avoid equities after their portfolio is decimated.

If you have a probable maximum loss plan it may cause you to invest more conservatively. Hopefully, it will cause you to take only risks that are prudent and fit into your long term plan.

This means valuation should be a major consideration in your asset allocation. It does not make sense to have a fixed asset allocation with no regard for the valuation of the asset. An adaptive asset allocation should be used for portfolio risk management.

Learn How to Establish a Probable Maximum Loss Plan:

2. Implement a Tactical Asset Allocation

Studies show that close to 90% of investment returns are determined by portfolio asset allocation. Yet most value oriented guidance focuses on choosing individual investments.

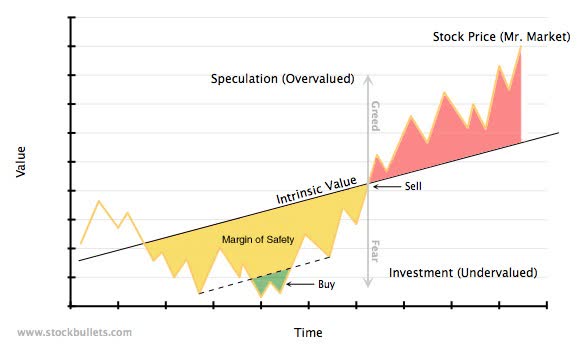

Don’t get me wrong. I spend a great deal of time looking for individual undervalued investment opportunities. Finding individual investments with a margin of safety is an important aspect of value investing. However, choosing your asset allocation is more important and therefore deserves your serious attention.

Simply stated, investment allocation is how you divide your assets between different investment classes or groups. A tactical asset allocation provides the investor a dynamic strategy that adjusts to favorable and unfavorable valuations. Instead of a strict fixed percentage you have greater flexibility because you can choose from a range based on valuation levels.

Different valuation levels should require a different investment allocation of your capital. One of the most important concepts in investing is to be careful or prudent about the price you pay. It’s not possible to do this without changing your allocation to asset categories after they make large price swings.

The value oriented investor would want to allocate more to assets that were priced the farthest below their real or intrinsic value. Assets that are priced above their real worth can be completely avoided or minimized.

We know from history that when valuations are high the expected long term (7 – 10 years) rate of return is lower than average. But when valuations are low the expected long term rate of return is much higher than average.

Consider your investment allocation during the first decade of this century. Should your portfolio have held the same percentage of equities when valuations were sky high (i.e. 2000) compared to after they fell 57% in 2008-09? Of course not.

We live in the best era in history for investing. Competition has reduced transaction costs on individual investments and produced new investment vehicles (i.e ETFs). This allows investors to move from overvalued assets to undervalued assets with relative ease. It no longer makes sense to maintain positions in grossly overvalued assets.

A tactical asset allocation is an effective means to portfolio risk management. During time periods when investment assets are overvalued an adaptive allocation allows an investor to increase cash positions. Cash can help protect your portfolio in bear markets. You cannot buy low and sell high by allocating money to assets that are expensive.

At the same time, having cash available when market valuations are low provides investors the ability to take advantage of favorable opportunities. Think about how much better you would do if you bought more when prices are low and less when prices were unfavorable. Many investors do just the opposite and wonder why long term returns suffer.

You should expect volatility and take advantage of it. Make it a point to understand how volatility affects performance. Here is a post that will help you understand why you MUST control your portfolio losses and reduce your portfolio volatility.

3. Require a Margin of Safety

Require a margin of safety for each individual investment.

Margin of safety is the difference between the fundamental or intrinsic value and the price of your investment. “Price is what you pay. Value is what you get.” (Warren Buffett)

The larger the margin of safety the less risk you assume, the greater your potential capital gains, and the higher your income percentage (i.e. dividend yield). A margin of safety leaves room for judgement errors, mistakes, or unforeseen adverse conditions.

Finding bargains is not always enough. Ideally we want to find stocks with the characteristics of quality companies: good management, strong balance sheets, innovation, competitive advantages, returns to shareholders, earnings stability, and efficient operations.

When a company is deficient in quality we have to 1) analyze the probability of the deficiency being rectified and adjust the price we are willing to pay by increasing the required margin of safety.

Be certain the company has one or more sustainable competitive advantages, otherwise your bargain may be a value trap. Competitive advantages can be key company assets, attributes, or abilities that are difficult to duplicate. These could include being a low cost provider, pricing power, powerful brands, strategic asset, barriers to entry, adapting product line, product differentiation, strong balance sheet, or outstanding management/employees.

4. Avoid Portfolio Volatility

Portfolio volatility has a large negative effect on long term returns. If you have a positive return of 50% and a negative return of 50%, the arithmetic average is 0%. But you have actually lost 25%, or one-quarter, of your portfolio.

This means that it’s in your long term interest to lower the volatility of your investment portfolio. The mathematics of compounding make it compelling to avoid downside volatility.

In a previous post we established portfolio volatility (see post below) lowers portfolio returns. I demonstrated how 3 portfolios with the identical arithmetic average returns (i.e. 5%) can provide different portfolio total returns, depending on their volatility. The more volatile portfolios underperform the less volatile portfolios.

You must comprehend this concept to understand why you need to control portfolio volatility or suffer the consequences. Two portfolios, with the same average rate of return can produce dramatically different portfolio values because of portfolio volatility.

You should expect volatility and take advantage of it. Make it a point to understand how volatility affects performance.

5. Rethink Your Time Horizon

I contend, in the long run, that most investors fail because they try to outperform the market in too short of a time horizon. Investing is a marathon, not a sprint. Put less focus on short term performance and greater emphasis on high probability strategies that create long term wealth.

Yes, I want my portfolio to do really well just like anyone else. But does it matter if I outperform the market this month, or this year, or even over several years? Or, are there more important considerations?

The problem with trying to beat the market in the short term is that it causes you to invest too aggressively when prices are expensive. The more expensive the market, the greater your emphasis should be on capital preservation.

What really matters is how your portfolio performs over a long period of time. Too short of a time horizon causes investors to focus on factors other than valuation and forget their investing principles .

How your portfolio performs over your entire investment time horizon is what’s important. Long term performance requires long term solutions and valuation should be the primary determinant of your investment decisions .

Both bull and bear markets move in long term cycles. An investor will find more opportunities (bargain prices) at the end of bear markets and at the beginning of bull markets. Therefore a value investors portfolio may be more volatile during times when bargains are available. This is because you should be more aggressive when prices are low.

However, there will be fewer opportunities (bargain prices) at the end of bull markets and the beginning of bear markets. An investor should have a portfolio that is less volatile when investment prices are expensive. This is because you should lower portfolio volatility and preserve your capital when investment prices are expensive.

Implementing Your Portfolio Risk Management Strategies – Concentrate On What You Can Control

Volatility is an inherent aspect of the stock market and is beyond your control, as is the market ‘s direction. Instead you should concentrate on what you can manage: your portfolio’s risk through effective portfolio risk management.

– Develop a plan for managing probable maximum loss.

– Use adaptive asset allocation strategies.

– Ensure a margin of safety by concentrating on valuation and price while controlling your emotions.

– Recognize how volatility can erode your portfolio returns.

– Prioritize long-term goals over short-term gains by adopting an appropriate time horizon.

Minimize Large Portfolio Drawdowns

Invest With Confidence in Less Time - Manage Your Portfolio Without Behavioral Errors