Tactical Asset Allocation

A tactical asset allocation is the value investors most important strategy tool. Buy and hold has failed for most investors. This is partly because it doesn’t work well in secular bear markets, and partly because investors let their emotions cause them to make poor decisions. This can be corrected by concentrating on value.

What is Tactical Asset Allocation?

Tactical asset allocation (sometimes a.k.a. adaptive asset allocation) is an active strategy which allows portfolio managers to change their target asset allocation according to the valuation of assets. It involves a continual management of risk through frequent portfolio rebalancing to a flexible asset allocation target.

We know from history that when asset prices are lower than their fundamental or intrinsic value they provide higher than average rates of return in the long run. When asset prices are expensive compared to their fundamental value they provide lower than average rates of return in the long run.

The purpose of a tactical asset allocation strategy is to increase risk adjusted returns as compared to a fixed or strategic asset allocation. The idea is to be more aggressive (invest more money) in lower risk undervalued assets, and be more conservative (invest less money) in higher risk overvalued assets.

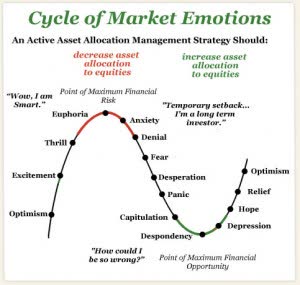

Cycle of Market Emotions

Investors can take advantage of portfolio volatility if they understand market emotions affect asset prices. When focusing on value, investors can look for opportunities in assets that are experiencing extreme pessimism, and look to take profits in assets that are experiencing a buying euphoria.

This is What You Should Remember About Tactical Asset Allocation

A tactical asset allocation strategy is the key tool to limit portfolio drawdowns and manage risk. All secular bear markets begin with high valuations. A tactical asset allocation provides the portfolio manager the flexibility to control losses by avoiding high valuation assets.

If you lose 50% of your portfolio it takes a 100% gain to get back to break even. The fact that large portfolio losses reduce the capital needed for investment at lower prices makes maximum portfolio drawdown a critical concept. It also accentuates how a tactical asset allocation can transform your investment future.

The principles of a tactical asset allocation can be applied to asset categories, sub-categories, sectors, and individual investments. As a value investor you want to only own assets that are priced with a margin of safety.

A value oriented tactical asset allocation puts the focus on owning assets priced below their intrinsic value. You don’t need to take excessive risk in order to obtain high rates of return. High long term returns are obtained by investing aggressively when the odds are heavily in your favor, and preserving capital when risks are high.

Related Reading: 5 Value Strategies for Asset Allocation

Shiller PE 10: An Important Stock Market Valuation Tool

Dividend Value Builder Newsletter

Minimize Large Portfolio Drawdowns

Invest With Confidence in Less Time - Manage Your Portfolio Without Behavioral Errors