Dividend Value Builder Newsletter

– Discover, Compare, and Evaluate Dividend Stocks Without Emotional Bias –

(Intrinsic Value Analysis For Over 300 Stocks)

Gross Profitability Ratio – Qualitative Analysis

Are you looking for quality companies?

The Gross Profitability Ratio is gaining credibility in investing circles because it provides valuable and predictive qualitative analysis when combined with valuation metrics. Some analysts argue it is the single best qualitative metric with which to compare multiple stocks (particularly within the same industry) that have already been determined to be bargains.

A high Gross Profitability Ratio is evidence that a company has sustainable competitive advantages. Otherwise competition would enter their business and lower their profits. The fact that they have above average profits means they are able to execute a superior or favorable position over their competitors.

Gross Profitability Ratio Formula

Gross Profitability = Gross Profit to Total Assets

Where:

Gross Profit = Revenues – Cost of Goods Sold (Income Statement)

Total Assets = The Sum of All Current and Long-Term Assets (Balance Sheet)

Why Gross Profitability Ratio is Better

Gross Profit is derived from the top of the income statement and therefore is considered a “cleaner” number than Net Income or EBIT as the numerator. Net Income and EBIT (used in the Joel Greenblatt’s Magic Formula) can be manipulated or distorted.

Gross Profit is the basics of what a company does. What does the company receive for its product and how much does it spend to produce its product? A company with high gross profit has the opportunity to make wise decisions on how they allocate capital (re-invest, reduce debt, shareholders). A company with low gross profit has a lower probability of being successful.

The objective is to find out how much profit the company’s assets are producing. Total Assets is used as the denominator as opposed to Invested Capital (used in the Magic Formula). This makes Gross Profitability independent of the capital structure or leverage of the company.

Cash actually becomes a penalty in the equation because it increases the denominator (cash is an asset) and lowers the Gross Profitability Ratio. This helps eliminate stocks from your screen that may be loaded with cash (and appear on value stock screens) but are not making money with their cash. It is a reasonable argument that this makes the Profitability Ratio perfect to pair up with Enterprise Value Ratios where cash makes the metric more attractive.

In other words, a list of stocks formulated from an Enterprise Value Ratio sorted by the Profitability Ratio provides a list of stocks that have been analyzed by the single best quantitative and single best qualitative metric. This is a powerful means to generate lists of quality companies that have a low-priced stock price.

A Short History

Benjamin Graham looked for stocks that were cheap, but wanted to buy quality companies that were cheap. The true bargain is buying a quality company with a low-priced stock.

It’s fairly easy to find bargain stocks. The hard part is finding low-priced stocks which will increase in price as investors realize the company has qualities that were not recognized in the stock price.

Robert Novy-Marx searched for a qualitative metric which would pair well with value metrics. He released a working paper in 2010, and a revised version in 2012, detailing the in-depth study on Gross Profitability including empirical evidence to back up his findings. For those interested in getting really deep into the subject you can find the study here:

Fat Pitch Financial Backtest

A far more simple and understandable study can be found on the Fat Pitch Financials Website:

Interested in Intrinsic Value Stock Analysis?

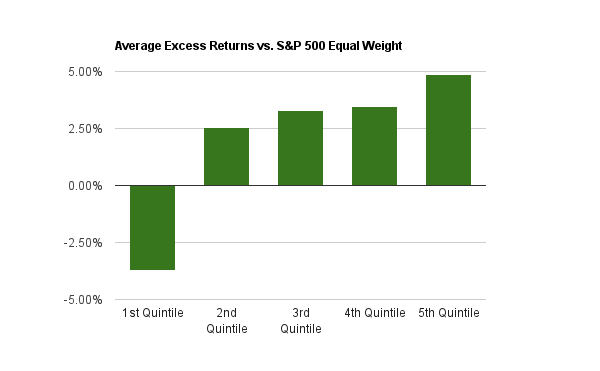

George’s backtest provides substantial evidence that companies with low gross profitability scores underperform companies with high gross profitability scores. This is true for every quintile; adding additional credence to the findings.

Conclusion

Gross Profitability is a qualitative ratio and my favorite metric to apply to stocks I have already determined to be cheap. It is the best measure of the productivity of the company’s assets.

The idea is to combine value and quality metrics to find quality companies whose stock price is a bargain. The most efficient approach is finding low-priced stocks first, then screen those stocks for quality with the Gross Profitability Ratio. Try it, you’ll like it. It works, and that is all that matters!

Additional Reading:

Intrinsic Value Stock Analysis – My Formula

Minimize Large Portfolio Drawdowns

Invest With Confidence in Less Time - Manage Your Portfolio Without Behavioral Errors