AAAMP Portfolios Membership Services

Arbor Asset Allocation Model Portfolios (AAAMP)AAAMP Premium Membership

- Includes Dividend Value Builder Newsletter plus all 7 AAAMP Portfolios (every service I produce, current & future).

- ALL AAAMP Portfolios are real-time asset allocation portfolios (equities & income) and include specific & concise trade alerts e-mailed before every transaction.

- AAAMP Dividend Growth & Income (DGI) - will most closely match the Dividend Value Builder Newsletter which seeks high total return by identifying dividend stocks that meet our risk adjusted margin of safety requirements.

- AAAMP Treasure Trove Dividend (TTD) - uses a value approach concentrating on the finest and most consistent dividend growth companies in the world: Dividend Kings, Dividend Aristocrats, and Dividend Champions (companies with 25+ consecutive years of dividend increases) and other companies deemed to be high quality. #1 priority is avoiding large drawdowns.

- AAAMP Global Dividend Value (GDV) - is our highest quality global portfolio and may be an appropriate retirement or long term growth portfolio option. Special attention is given to dividend quality, safety, and inflation protection. Risks are managed with value strategies and an asset allocation with maximum flexibility.

- AAAMP Global Value (GV) - is one of our more conservative portfolios and a retirement and long term growth portfolio option. This is my flagship portfolio and has a 23 year track record of low volatility and outstanding returns. #1 Priority: Avoid large drawdowns. Our goal is to build wealth with a slow and steady approach that only accepts risks when the probability of success is heavily in our favor. Risks are managed with value strategies and maximum flexibility.

- AAAMP Global Value Aggressive (GVA) is one of our more aggressive portfolios and a long term growth portfolio option. Our goal is to build wealth with an approach that invests aggressively but with a healthy dose of risk management.This is the more aggressive brother of our more conservative Global Value portfolio. The GVA will hold many of the same investments but with a sprinkling of higher return/higher risk investments and a more aggressive overall asset allocation.

- AAAMP Global Conservative Income (GCI) - goal is to provide members an easy to follow global income portfolio with greater growth of income than money markets but with less risk and volatility than a typical equity portfolio.

- AAAMP Global Aggressive Income (GAI) - one of our most aggressive portfolios and holds individual assets with above average yields and risks. This is a great second portfolio for investors to achieve higher yields and increased overall portfolio diversification. High yield is difficult to find without taking extraordinary risk of large portfolio drawdowns. I provide members an easy to follow global high yield portfolio with lower than typical high yield risk. Risks are managed with diversification and an asset allocation with maximum flexibility.

- Call Ken Faulkenberry at 832-585-7618 for membership access and a free preview of all services.

AAAMP portfolios are designed to assist investors in managing their own money in a minimum amount of time. The portfolios are laid out in a simple and concise manner with easy to follow specific trade alerts. This service provides all the resources so you can develop your own plan with confidence. I do the work, you stay in control!

The highest priority of each portfolio is minimizing large portfolio drawdowns. Asset allocation decides up to 90% of total investor returns. This is where investors make the most mistakes and the largest behavioral errors. I will help you concentrate on the aspects of investing that grow wealth little by little.

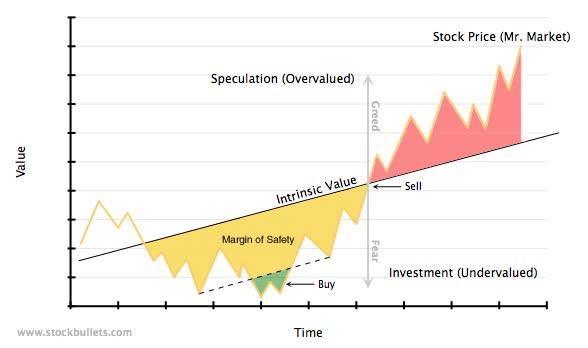

We focus on ideas and concepts inspired by Benjamin Graham (The Intelligent Investor) and Howard Marks (The Most Important Thing). This philosophy puts special emphasis on value investing strategies: requiring a margin of safety, risk management, proper asset allocation, and avoiding behavioral errors.

Our approach is to invest defensively when valuations are high. However, we want to be ready (emotionally) and able (cash!) to invest more aggressively when a margin of safety exists. This reduces portfolio volatility and allows us to avoid large drawdowns that destroy long term returns.

I am dedicated to helping investors implement sound investment strategies, methodically build wealth, and mitigate risk. Each model portfolio is a real-time portfolio; part of my personal retirement portfolio. In other words I put my money where my mouth is!